Farm Bill Online and Spreadsheet Tools

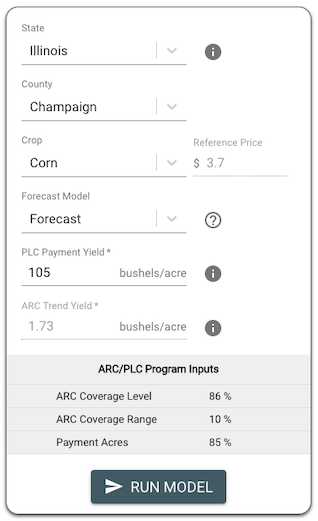

Gardner Program Payment Calculator (ARC/PLC)

The Gardner Payment Calculator provides estimates of expected payments and likelihood of payments for ARC-CO and PLC. Payment estimates are provided for the program years from 2019 to 2023. Users can select the state, county, and crop combination that they wish to consider.

If you are having trouble registering please view the faq or watch the video below.

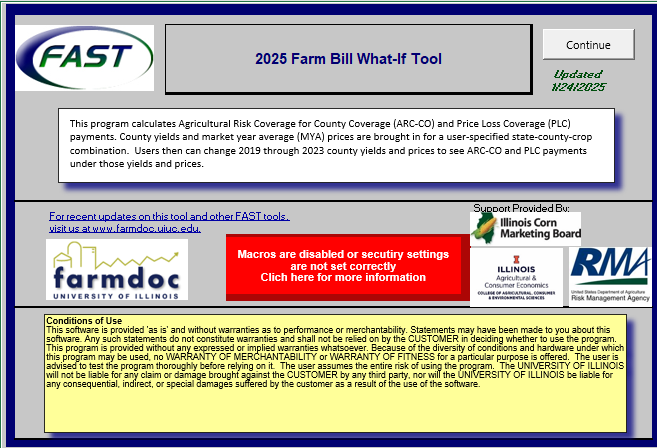

2025 Farm Bill What if Tool

This program calculates Agricultural Risk Coverage for County Coverage (ARC-CO), Price Loss Coverage (PLC) payments, and ARC at the Individual Level (ARC-IC). County yields and market year average (MYA) prices are brought in for a user-specified state-county-crop combination. Users then can change county yields and prices to see ARC-CO and PLC payments under those yields and prices.

The Reconciliation Farm Bill: Top Five Most Problematic Changes to Farm Policy, #4

The number four spot in the top five most problematic changes to farm policy in the Reconciliation Farm Bill belongs to possibly the most obscure change in the agriculture title. Congress provided an additional subsidy to crop insurance companies to encourage continued sales of policies in high-risk states. This article explains the policy change and offers some perspective.

Projections of Commodity Program Payments for Illinois in 2024 and 2025

Commodity program payments for 2024 are estimated to be limited to ARC-CO in some southern and northern Illinois counties for corn and soybeans. Commodity title program payments seem more likely to occur for the 2025 commodity title program. Even with the larger payment expectations, due in part to changes to commodity programs in the OBBB Act, 2025 return prospects remain negative for cash rented farmland in Illinois. This could lead to calls for additional ad hoc support for 2025.

The Farm Bill in Reconciliation: Loophole as Rosetta Stone; Review and Comment

As of July 4, 2025, budget reconciliation, bearing the title “One Big Beautiful Bill Act,” is Public Law. Among its many provisions are revisions to the major mandatory programs of the Farm Bill, reauthorizing them through 2031. Rushed through Congress under special budget procedures and a dearth of deliberation, much about this new federal law remains confusing and dismaying. This article reviews an expanded loophole for farm program payment limitations as a potential Rosetta Stone.

Impacts of the Commodity Title Changes Under the One Big Beautiful Bill Act (OBBBA) for Midwestern Farms in 2025

This farmdoc daily article discusses the changes made to the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs in the commodity provisions of the budget reconciliation legislation known as the One Big Beautiful Bill Act (OBBBA). For the 2025 crop year, the new commodity title provisions are expected to increase payments by significant amounts. Those payments, however, will not be received until October 2026.

Reconciliation Bill Proposals to Add Base Acres

The Reconciliation Bills moving through Congress include proposals that would increase the number of base acres eligible for farm program payments. For farms that planted acreage to eligible crops from…

Dramatic Difference in Expected Yields between Corn, Soybeans, and Cotton for Area-Based Insurance Products

Both the House and Senate Reconciliation Bills include provisions to encourage the purchase of the Supplemental Coverage Option (SCO). Since 2015 when SCO was first offered, actual county-level yields of corn and soybeans in the Midwest have been above expected yields in most years, implying a continuation of historical increases in yield and lower expectations for indemnities. On the other hand, actual county-level yields have been below expected yields for the majority of years for cotton.

The House Reconciliation Bill Proposal for SCO: Income Support for High-Risk Farmland

The House Reconciliation Bill includes provisions to modify the Supplemental Coverage Option, a crop insurance product providing county coverage above Revenue Protection and other farm-level products. This article examines what the payments would have been from 2015 to 2023 under the proposed structure and finds that the proposed SCO product would have limited benefits to corn and soybean production in many Midwest states. More benefits, however, would have flowed to riskier production regions.

Impacts of Premium Support Increase of Basic and Optional Units in House Reconciliation Bill

The House Reconciliation Bill includes provisions that would increase premium support rates on basic and optional units. Given that farmers do not change their policies, units, or coverage levels, we…

Spending Impacts of PLC and ARC-CO in House Agriculture Reconciliation Bill

The House Reconciliation Bill includes changes to statutory reference prices used to trigger payments from the Price Loss Coverage (PLC) program, as well as changes to Agricultural Risk Coverage (see…

Reviewing the House Agriculture Committee’s Reconciliation Bill

Budget reconciliation has begun in the House of Representatives, with multiple committees releasing text and holding business meetings to mark-up the legislation. As part of that process the House Agriculture…

Additional Thoughts on 2025 Crop Insurance and Farm Program Decisions

The deadline to finalize 2025 crop insurance decisions is now less than a week away (March 17th). The harvest futures contracts for corn (December) and soybeans (November) have moved below…

The Arithmetic of Commodity Title Programs

Increasing per-acre corn payments for commodity title programs will have a much more significant effect on total Federal outlays than other crops because corn has many more base acres. Seed cotton, rice, and peanuts have lower base acres; hence, spending increases tend to have much less impact on total Federal outlays. As a result, seed cotton, rice, and peanuts often have larger per-acre increases in spending than does corn. This process is illustrated with the House Proposal for the Farm Bill.