Additional Thoughts on 2025 Crop Insurance and Farm Program Decisions

The deadline to finalize 2025 crop insurance decisions is now less than a week away (March 17th). The harvest futures contracts for corn (December) and soybeans (November) have moved below…

Crop Insurance Decisions for 2025

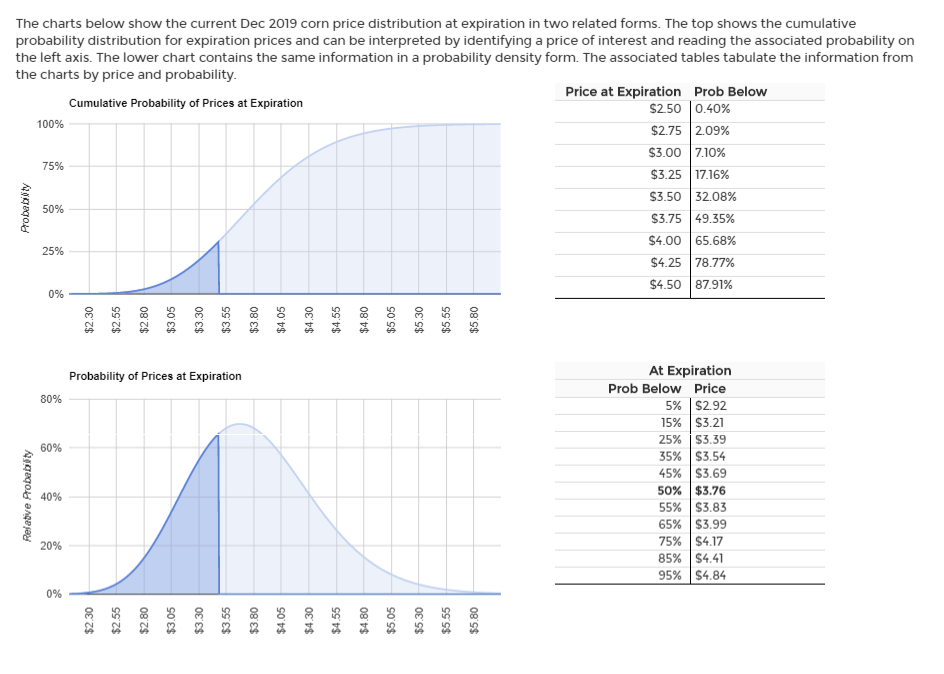

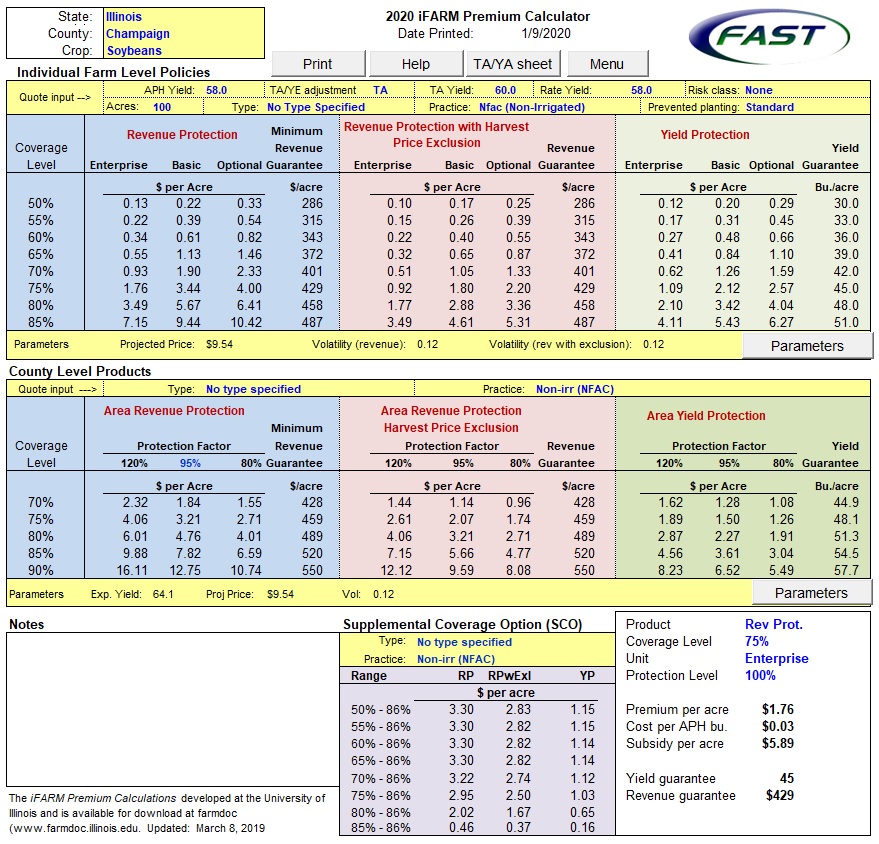

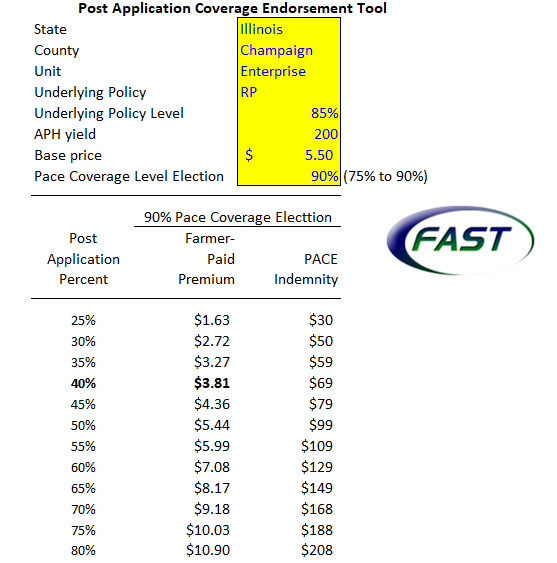

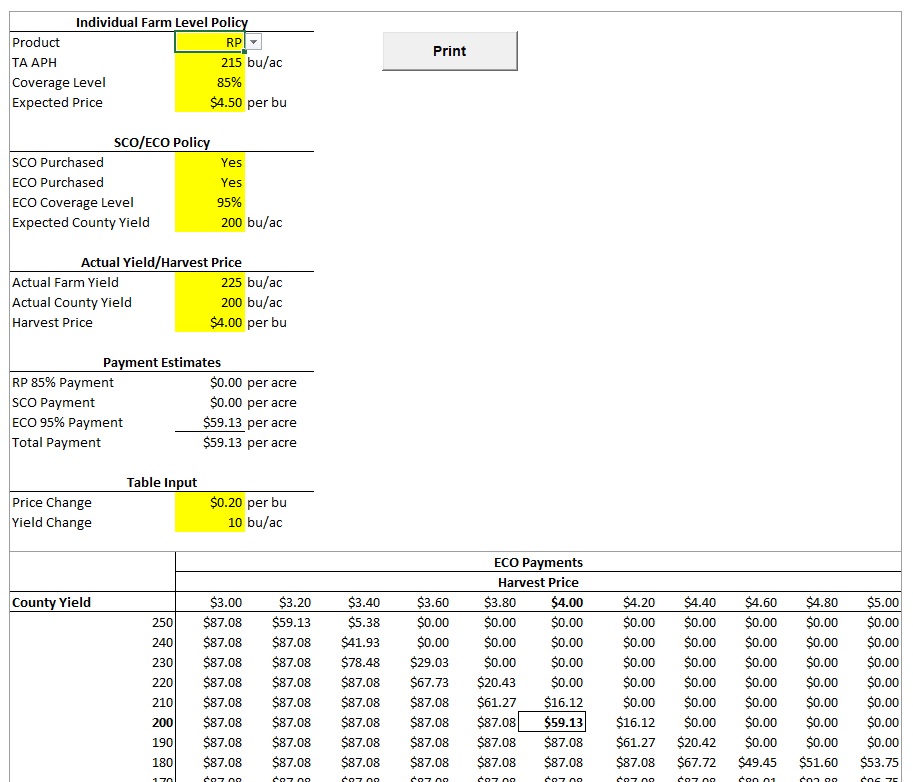

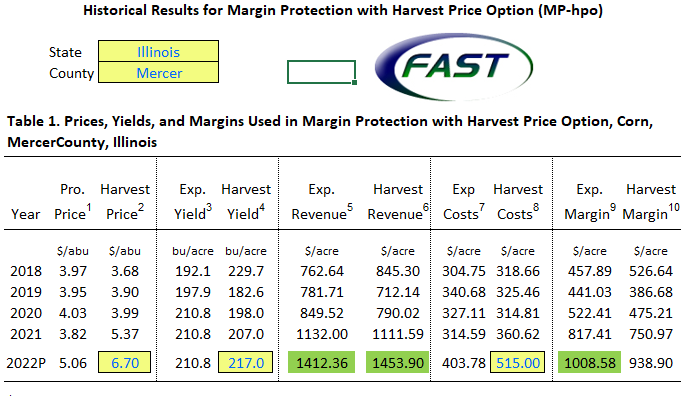

The price discovery period for federal crop insurance policies with a March 15th sales closing date ended on February 28th. Insurance guarantees for 2025 are low compared to the 2022 and 2023 crop years when projected prices were higher for both corn and soybeans. This coupled with a higher subsidy rate for 2025 might make the Enhanced Coverage Option (ECO) of greater interest to producers to supplement their Revenue Protection (RP) or alternative individual plan coverage.

Enhanced Coverage Option for 2025

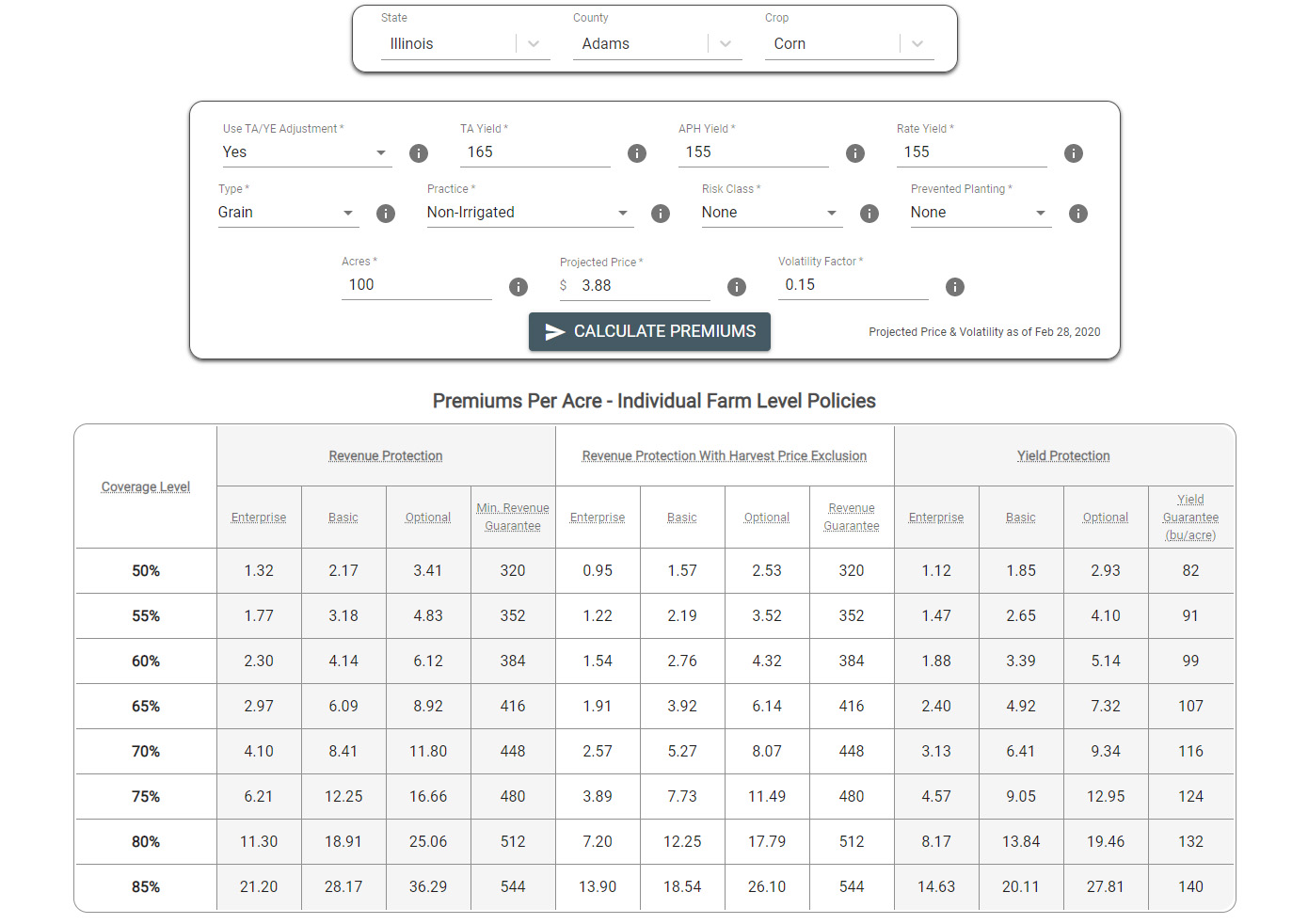

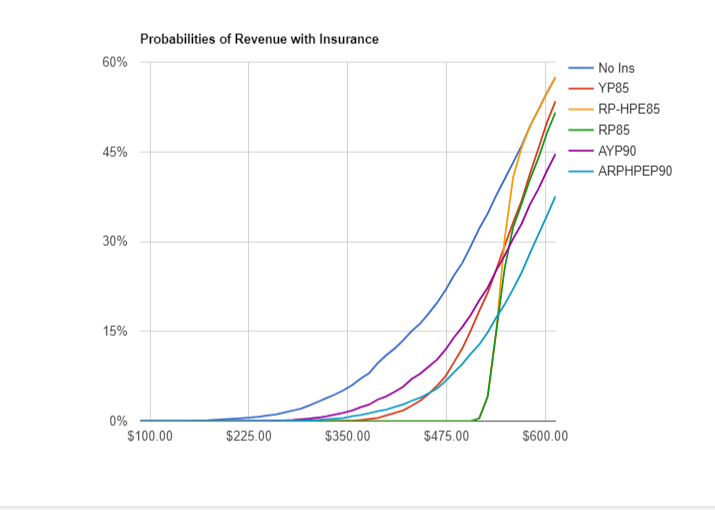

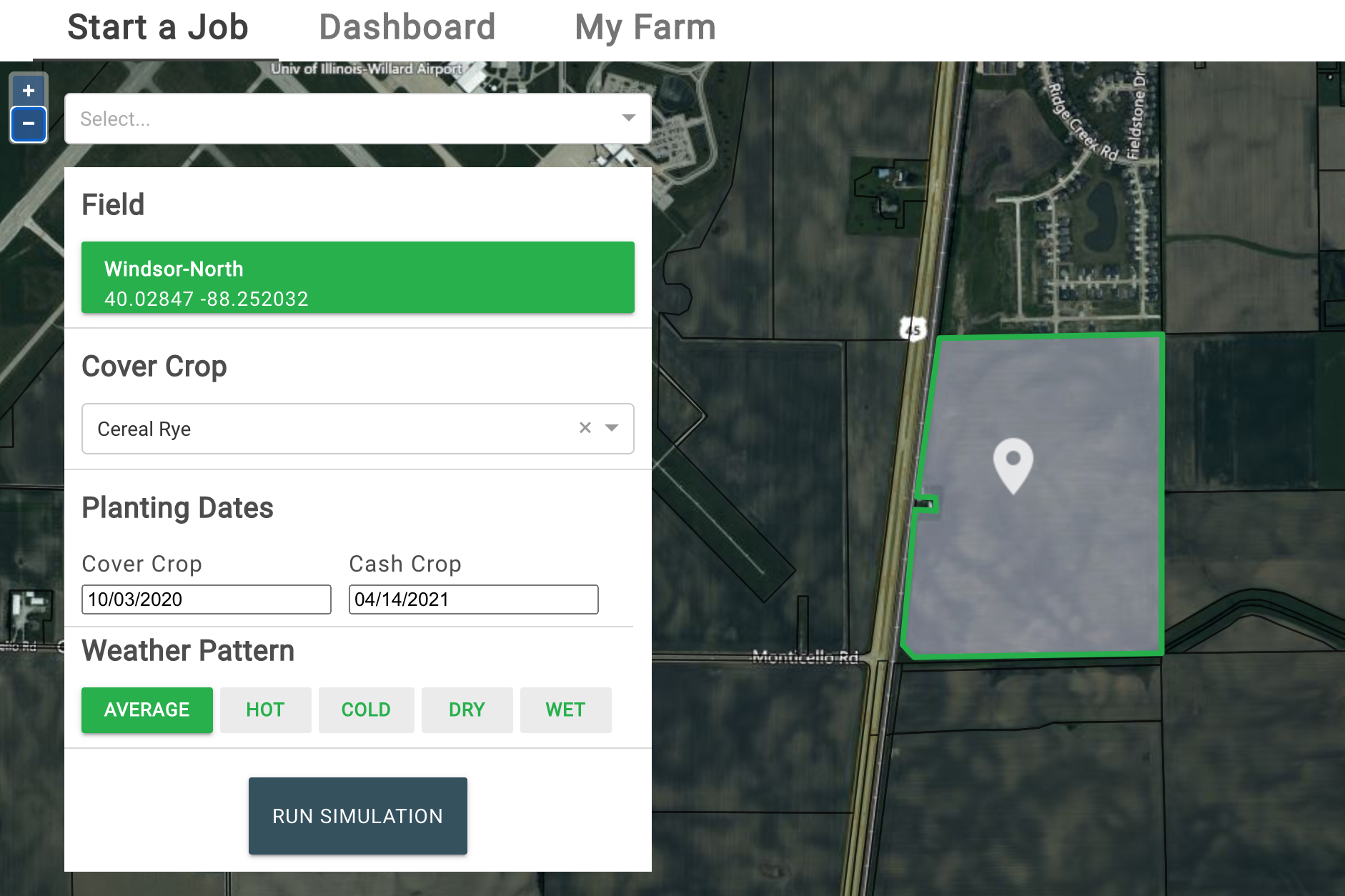

Farmers may wish to consider the Enhanced Coverage Option (ECO), a county-level crop insurance product, because its premium in 2025 is lower than in 2024 and because Revenue Protection will likely cover less of the 2025 cost of production. Note, however, that many counties would not have had payments exceeding farmer-paid premiums from 2015 to 2023, even with the increased subsidy rate. Premiums for all Federal products can be obtained using farmdoc’s 2025 Crop Insurance Decision Tool.

The farmdoc Crop Insurance section offers iFARM online tools including the Premium Calculator, Payment Evaluator and Price Distribution Tool. These tools are updated annually during the Spring crop insurance election period.