Revisiting the Basis Risk when evaluating SCO and ECO

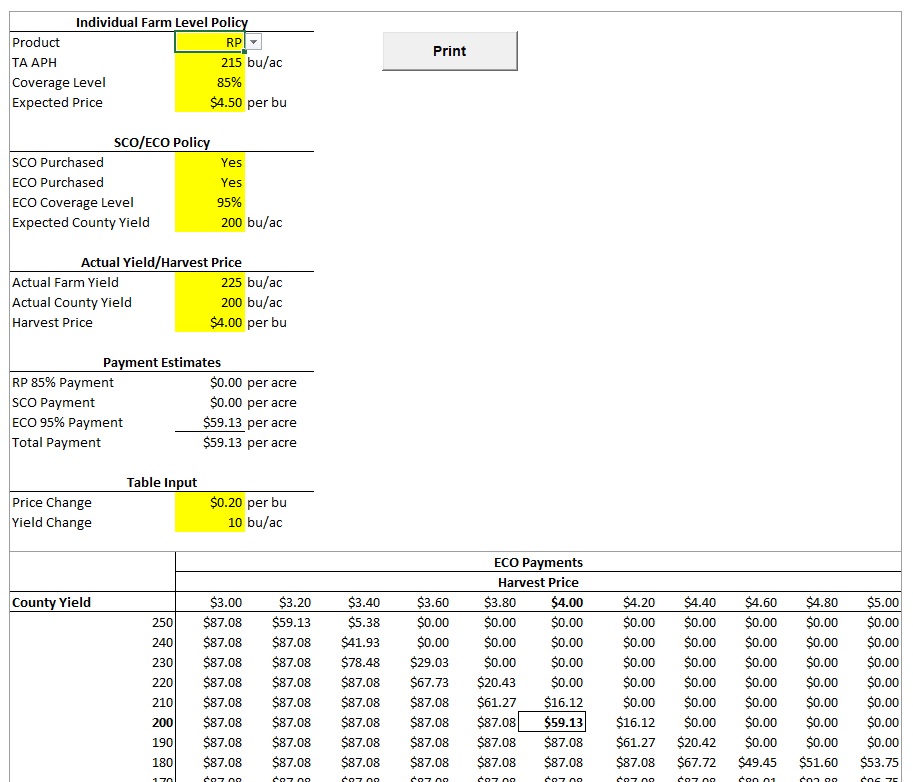

Substantially increased subsidies for Supplemental Coverage Option (SCO) and the Enhanced Coverage Option (ECO) as well as the independence from Title I program choices have led farmers to evaluate adding…

Comparing Crop Insurance Scenarios with SCO and ECO for 2026

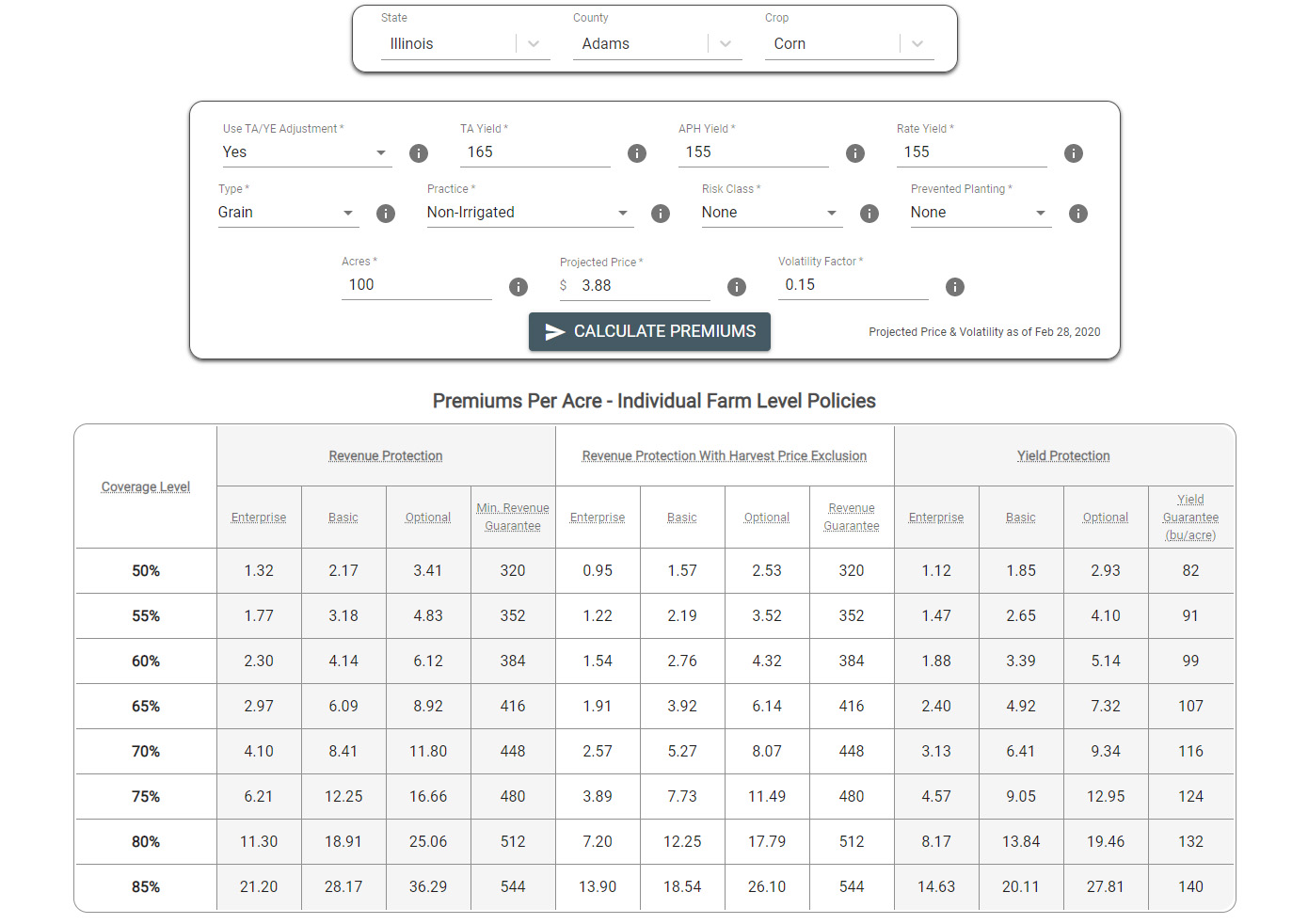

Significantly reduced farmer-paid premiums for Supplemental and Enhanced Coverage Option (SCO and ECO) policies suggest that farmers should consider using these products in their 2026 crop insurance portfolios. Adding SCO and ECO to higher coverage level farm-level plans such as Revenue Protection (RP) will increase expect returns and reduce risk, while also increasing total premium costs. Expected returns can be increased more by reducing RP’s coverage level while still using ECO and SCO.

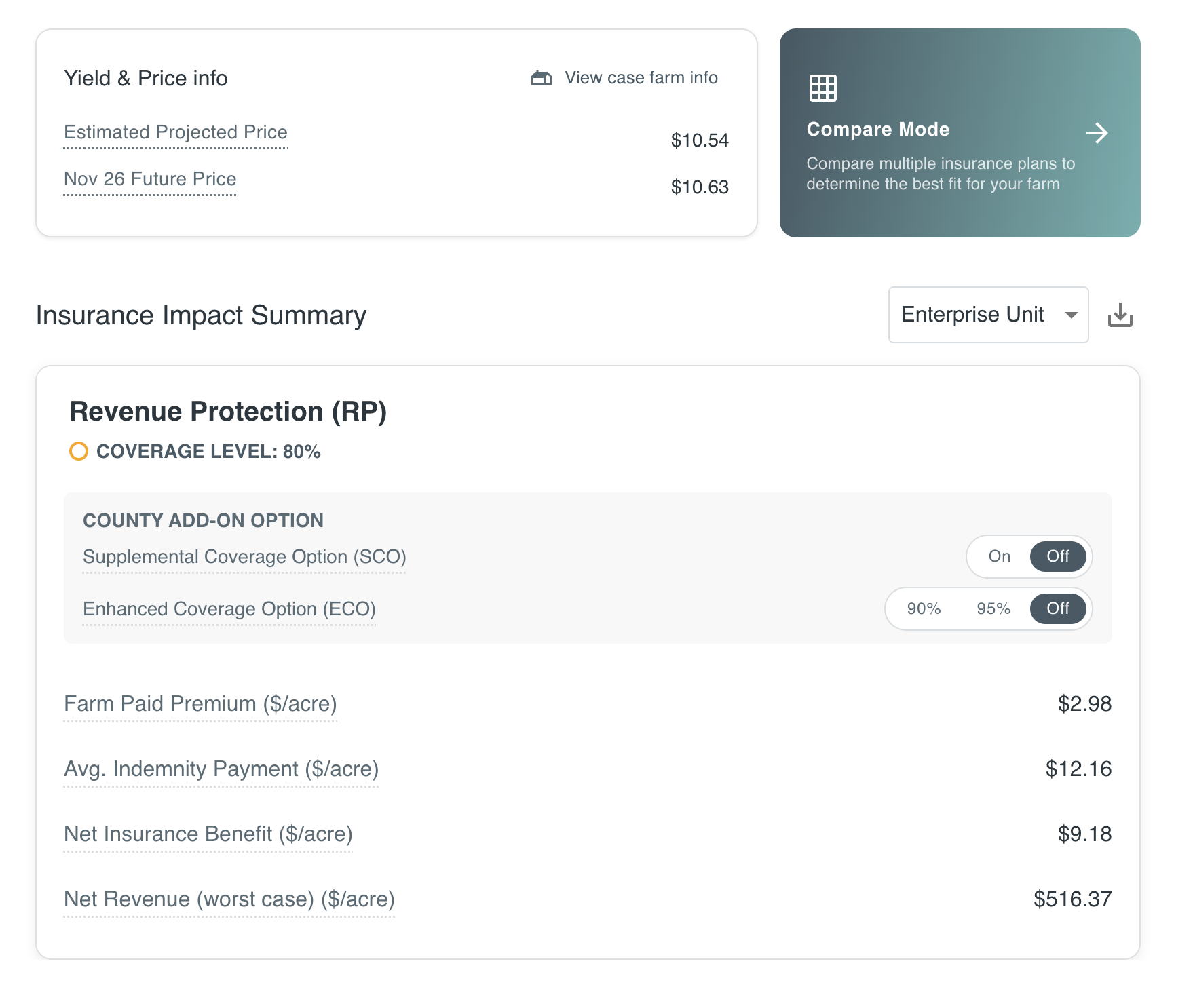

Release of Insurance Evaluator with the New SCO and ECO

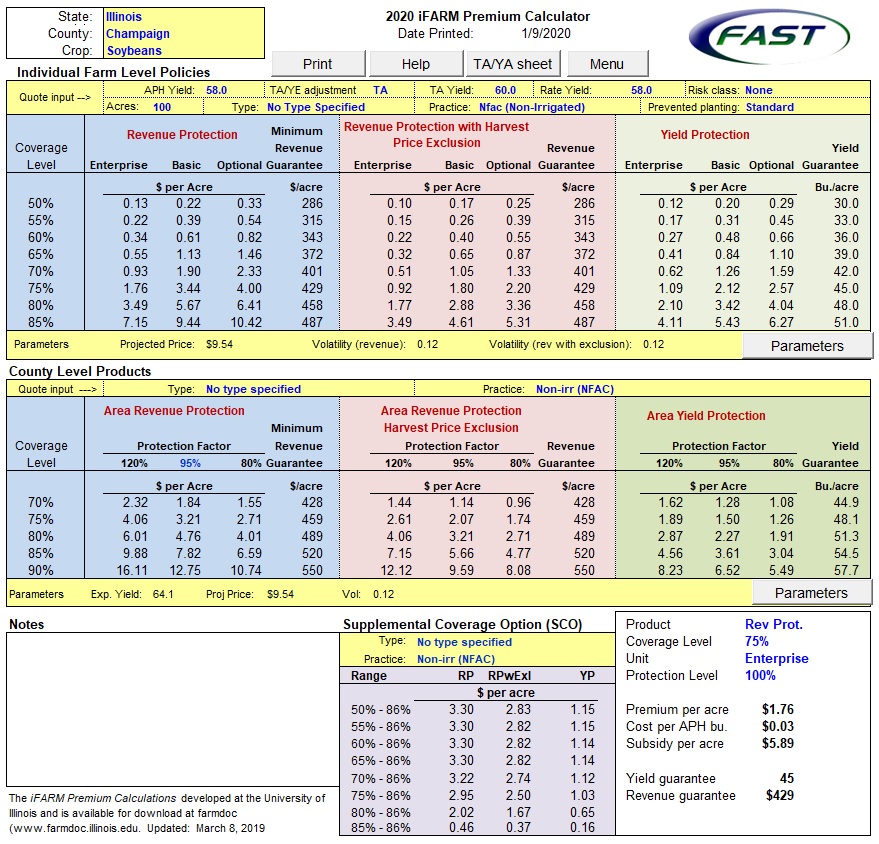

We have recently released a new Insurance Evaluator on the farmdoc website. The revised tool takes into account recent increases in pre-mium support for the Supplemental Coverage Option (SCO) and the Enhanced Coverage Option (ECO), as well as increases in support for the COMBO product. As a result of these premium support changes, many farmers may consider taking ECO and SCO and potentially lowering RP coverage levels, particularly for soybeans in the central part of Illinois.

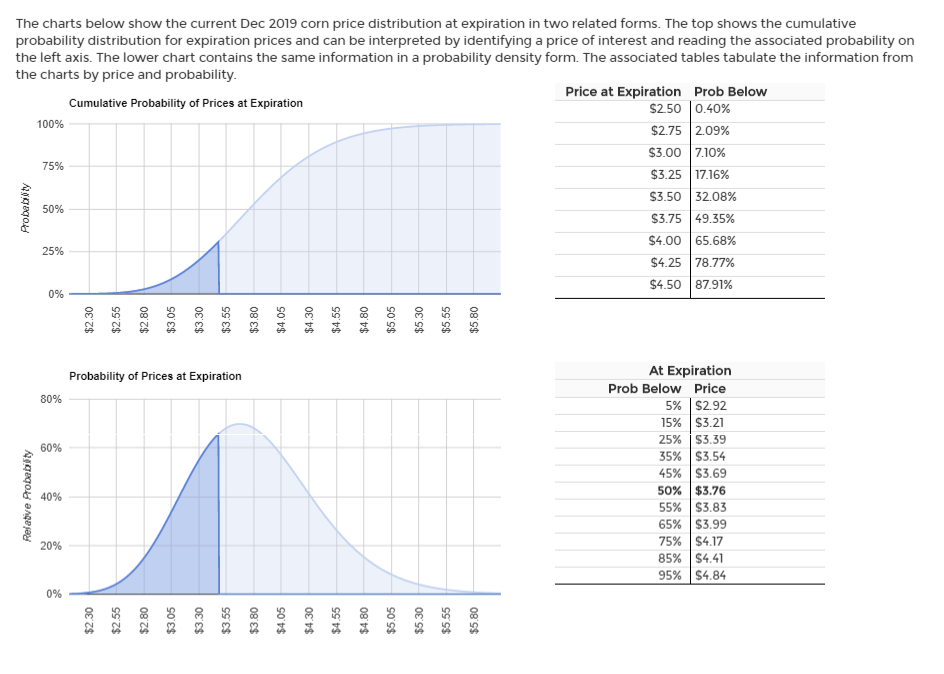

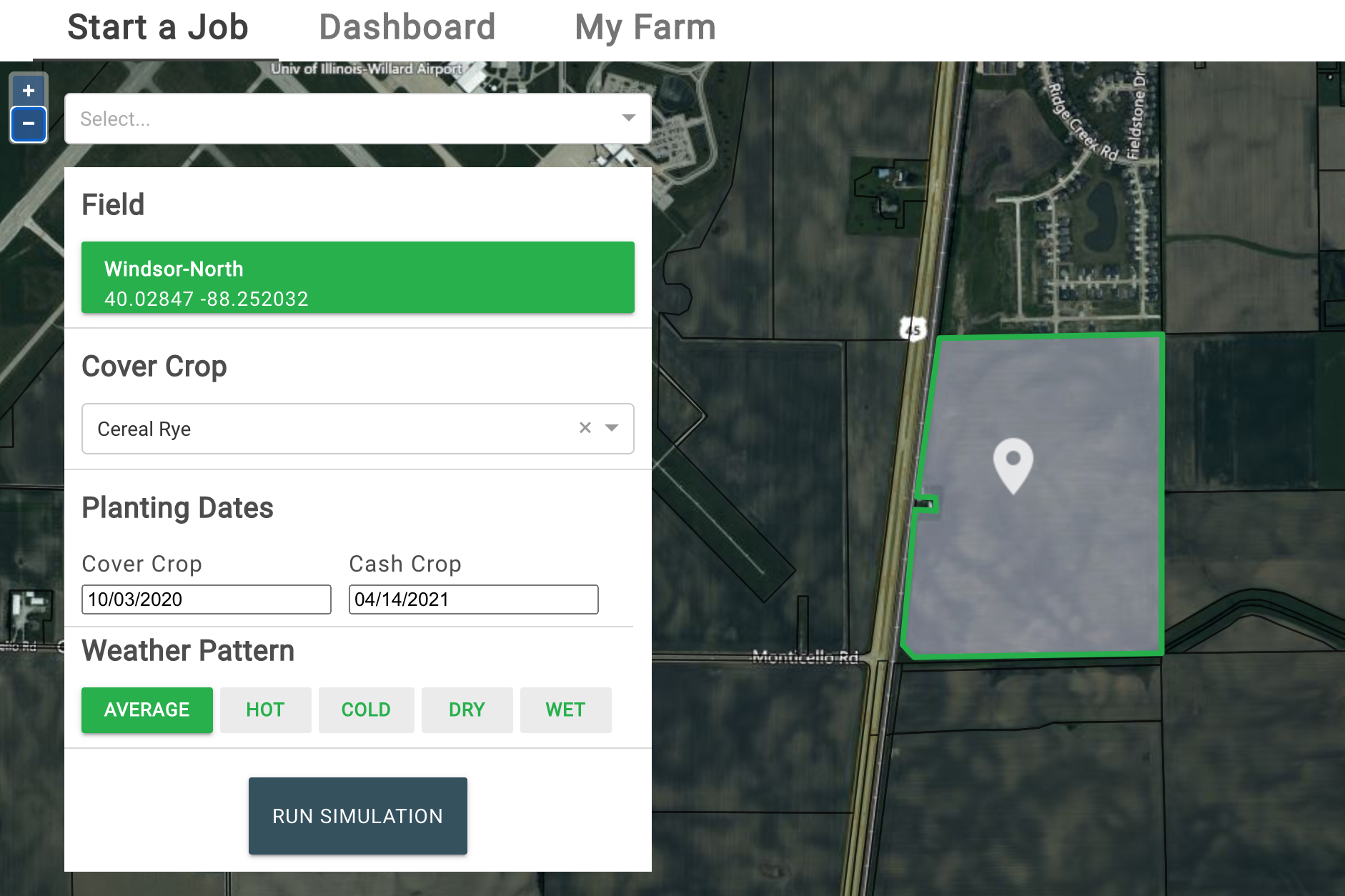

The farmdoc Crop Insurance section offers iFARM online tools including the Premium Calculator, Payment Evaluator and Price Distribution Tool. These tools are updated annually during the Spring crop insurance election period.